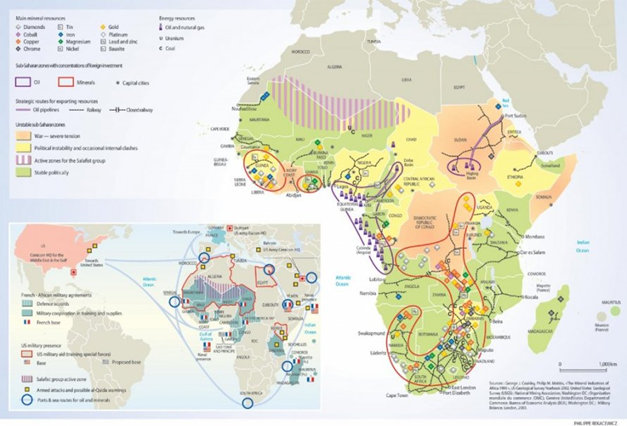

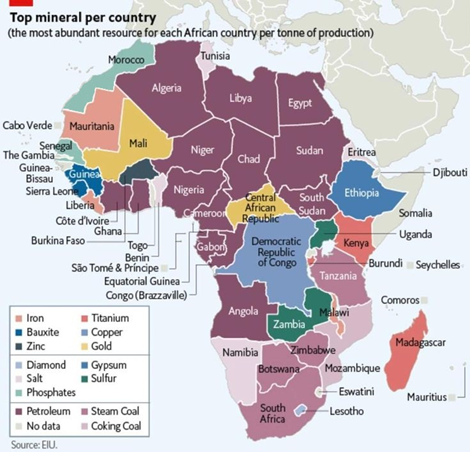

Africa has the largest mineral reserves on the planet, globally 30% of the world’s reserves. This includes 75% of the world’s platinum reserves, 50% of diamonds and chrome, 20% of gold and uranium, 85 to 95% of chrome and platinum group metals, 85% of phosphate reserves, more than 50% of cobalt reserves, 33% of bauxite reserves (and coal, copper, iron ore, etc.), 10% of the world’s oil reserves, and 8% of natural gas reserves. What’s more, the continent contains many unexplored geological regions and, in addition to proven reserves, other future discoveries could therefore be added.

These riches were exploited during the pre-colonial period, particularly salt, gold and copper, helping to create rich and powerful empires. Then, during the colonial period, economies were highly specialized in creating colonial mining rents, leaving the new states after independence with extroverted and poorly diversified rentier economies (rentier state). Currently, the majority (60%) of Africa’s exports concern raw materials; Africa is therefore highly dependent on them. In addition, it exports its wealth without adding value to it, due to a lack of local industries. This is the Dutch disease: the rent provided by raw materials tends to undermine local industries, particularly manufacturing. The level of training of human resources also plays a role in African specialization because abundant resources and a relatively unskilled workforce encourage the export of raw materials (which is also the case for agriculture).

Between the 1990s and the first decade of the 21st century, activity in the sector increased significantly (87%); consequently, contrary to the global trend, the continent’s share of global extraction is growing slightly: 7.5% in 1980 and 7.8% in 2008. Foreign direct investment (FDI), which is increasing after reaching a low point in the 1990s and represents a significant share of the GDP of the countries concerned (the proportion ranging from 3.5% for resource-poor countries to 2.4% for resource-rich countries), mainly concerns the extractive industries. But this orientation of investments towards the exploitation of raw materials does not produce the development effects that the continent needs, particularly in terms of job creation.

The most important mining economies are Guinea (bauxite), Liberia, Sierra Leone and Botswana (diamonds), Mauritania (iron, oil), Niger (uranium, oil), Togo (phosphate), the Democratic Republic of Congo (copper, coltan) and Zambia (copper). The main sub-Saharan oil economies are Angola, Congo, Gabon, Equatorial Guinea, Nigeria, South Sudan and Chad; in North Africa, Algeria and Libya also have economies that rely heavily on oil.

According to the International Energy Agency’s 2023 Energy Investment Report, Africa is the region that attracted the most investment in liquefied natural gas (LNG) in 2022 after North America. The region is expected to maintain its level in the coming years behind the United States and the Middle East. Investments in refining in Africa are expected to exceed those in the Middle East in 2023, surpassed only by China and India, with a total of around $10 billion, or a quarter of global investments. The main oil and gas projects in Africa are TotalEnergies’ Area 1 LNG (T1-T2) in Mozambique (expected production in 2026 of 3 billion barrels of oil equivalent of LNG, worth $10 billion), NNPC’s NLNG T7 in Nigeria (expected 2024 production of 2.5 billion barrels of oil equivalent of LNG), TotalEnergies’ Tilenga in Uganda (expected 2026-2027 production of 1,055 million barrels of oil), Exxonmobil’s Area 4 LNG (T1-T2) in Mozambique (expected 2029 production of 925 million barrels of oil equivalent of LNG), BP’s Greater Tortue Ahmeyim FLNG phase 1 in Mauritania (expected 2023 production of 915 million barrels of oil equivalent of LNG and oil), Waha in Libya (expected 2027 production of 775 million barrels of oil equivalent of gas), A&E Structures of Mellitah in Libya (expected 2025-26 production of 705 million barrels of oil equivalent of gas and oil).

The Democratic Republic of Congo estimates its reserves at 22 billion barrels and only exploits 4.5% of them; it has launched the auction process for 27 oil blocks. The Republic of Congo has just inaugurated its first gas liquefaction unit, which should eventually produce 3 million tons per year. Senegal plans to start extracting gas by 2024 at the latest; its three ongoing projects, GTA operated with Mauritania, Sangomar and Yakaar Teranga, have estimated reserves of 650 million barrels of oil and nearly 1,000 billion cubic meters of gas. Discoveries are multiplying off the coast of Namibia, which could double its GDP in less than ten years.

For more information :

- https://fr.wikipedia.org/wiki/Portail:Afrique

- https://en.wikipedia.org/wiki/Africa

- https://africacenter.org/

- https://journals.openedition.org/etudesafricaines/

- https://etudes-africaines.cnrs.fr/

- https://journals.openedition.org/etudesafricaines/

- https://www.afdb.org/fr/documents-publications/economic-perspectives-en-afrique-2024